|

Tax planning is a crucial aspect of financial management that enables individuals and businesses to minimize their tax liability and maximize their tax benefits. By utilizing the available deductions and credits, you can reduce your taxable income and ultimately lower the amount of taxes you owe.

In this article, we’ll take a look at some of the most effective tax planning strategies that can help you maximize your tax benefits and save you money. The tax code is a complex system of laws and regulations that govern how individuals and businesses are taxed. It can be difficult to understand, especially for those who are new to the world of taxes. However, with a basic understanding of the tax code and its principles, you can become a more informed and empowered taxpayer.

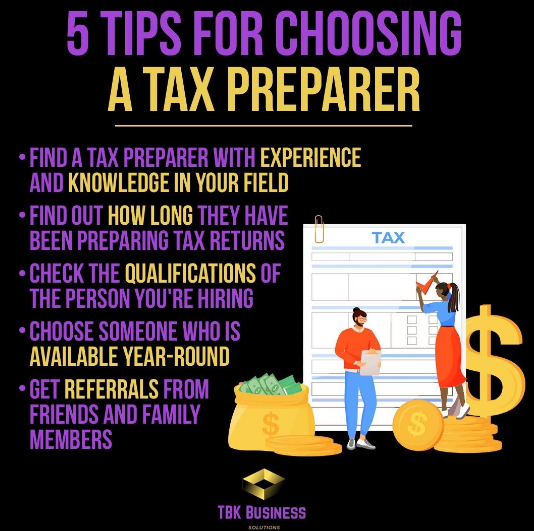

Filing taxes can be a complicated and time-consuming process, especially if you are not familiar with the ins and outs of the tax system. However, with the right preparation and information, you can ensure that your tax filing experience is smooth and stress-free. Here are some tips to help you navigate the tax filing process.

Tax compliance is the process of ensuring that individuals and businesses comply with tax laws and regulations. Failure to comply with tax laws can result in penalties, fines, and even criminal charges. Therefore, it is important to be aware of the various tax laws and regulations and how to comply with them.

Tax season can be a stressful time for many people, especially for those who are not well-versed in tax laws and regulations. However, with a little bit of planning, you can minimize the stress and maximize your tax benefits. Whether you are a business owner, freelancer, or salaried employee, this guide to smart tax planning will help you understand the key tax-saving strategies that you can use to reduce your tax bill and keep more of your hard-earned money.

Tax season can be a stressful time for many people, especially if they are not fully aware of their tax obligations. Understanding your tax obligations is key to getting ahead of tax season and avoiding any potential penalties or headaches.

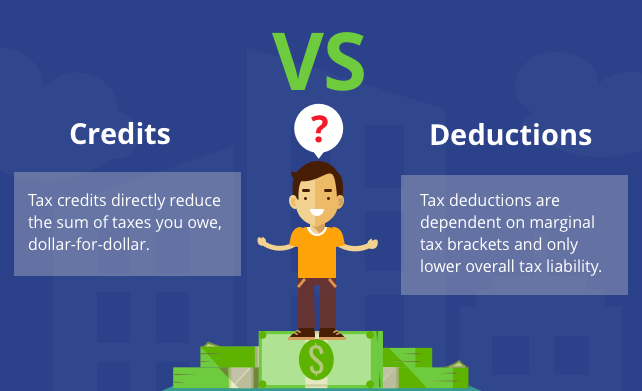

When it comes to filing your taxes, you’ve probably heard the terms “tax credits” and “tax deductions” being tossed around. Understanding the difference between these two concepts is crucial to maximizing your financial benefit when tax season rolls around. The key difference between a tax credit and tax deduction is that a tax credit directly reduces the amount of taxes owed, while a deduction reduces taxable income.

It’s no secret that 2022 was an unpredictable and challenging year for many people around the world. And when it comes to taxes and filing for a refund, this year has posed some unique challenges as well. While it’s too soon to predict precisely what changes 2023 and beyond may bring, there are some indications that your tax refunds may be smaller in 2023 if you don’t make proactive adjustments now.

|

�

categories

Categories

All

|

RSS Feed

RSS Feed