|

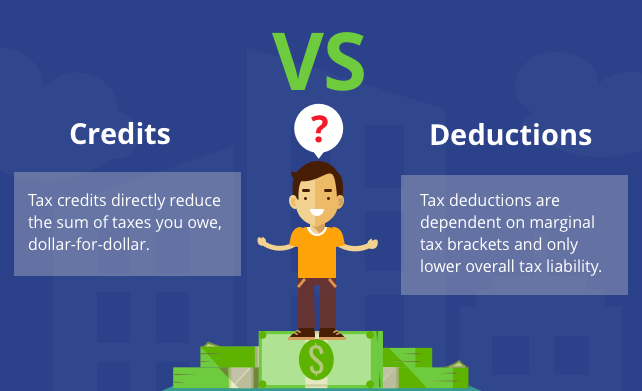

When it comes to filing your taxes, you’ve probably heard the terms “tax credits” and “tax deductions” being tossed around. Understanding the difference between these two concepts is crucial to maximizing your financial benefit when tax season rolls around. The key difference between a tax credit and tax deduction is that a tax credit directly reduces the amount of taxes owed, while a deduction reduces taxable income. Understanding- Tax credits Tax credits are dollar-for-dollar reductions in your taxes owed and can provide incredible savings for taxpayers. For example, if you owe $3,000 in taxes and have a $1,000 tax credit available, then your total taxes due drops to $2,000. This can be particularly beneficial for those who may not have enough income to itemize deductions but still seek to reduce taxable income. Understanding-Tax deductionsTax deductions reduce the amount of income subject to taxation and are often referred to as “above-the-line” deductions since they are reported on the first page of your tax return (Form 1040). Standard deductions generally range from $6,300 -$12,600 depending on filing status and age. Other common itemized deductions include donations to charity as well as home mortgage interest payments or medical expenses exceeding 7.5% of Adjusted Gross Income (AGI). However, keep in mind that itemized deductions are only allowed if they exceed the standard deduction threshold set by the IRS each year. Both tax credits and deductions can be very useful when filing your federal income taxes; however there are pros and cons with both options so it pays to do your research ahead of filing time! Tax credits tend to offer more direct benefits than deductions since they offer an immediate dollar for dollar reduction in what you owe Uncle Sam. On the other hand, certain types of itemized deductions—like charitable contributions or real estate taxes—are excluded from accounting for alternative minimum tax liabilities which may make them more advantageous depending on dealing with AMT issues (Allen Taxes). When considering either option make sure you know what qualifies before committing!

In summary, learning how best to use both tax credits and deductible strategically can help you save money this upcoming April when Tax Day rolls around! Understanding their differences will help ensure that you maximize any potential benefits when filing your return each year. Be sure to consult a qualified CPA or Tax Professional if you need any advice regarding these matters so that you get back every penny possible come next April!

0 Comments

Leave a Reply. |

�

categories

Categories

All

|

RSS Feed

RSS Feed